Return on investing in innovative activities: the brazilian manufacturing industry

DOI:

https://doi.org/10.5585/2023.22797Keywords:

innovation, investment, technological innovationAbstract

Objective of the study: This study analyses the relationship between innovation investment and the number of firms that innovate in various sectors of the Brazilian manufacturing industry.

Methodology/approach: The estimated multiple linear regression model with panel data based on triennial investments covering 1998–2017 was considered.

Originality/Relevance: This study indicates that investment in R&D, both internal and external, does not influence the number of companies that have implemented certain types of innovation.

Main results: Investment in training and machinery/equipment acquisition showed a positive and significant relationship with the number of companies implementing some type of innovation in the analyzed sector.

Theoretical/methodological contributions: These findings contribute to better management of resources spent on innovation activities while filling a theoretical gap in the impacts of different innovative activities, considering the Brazilian manufacturing industry.

Social/management contributions: The return on innovation investment is uncertain in the organizational context. Understanding the return on investment in innovation activities contributes to decision-making regarding resource allocation, especially in organizations with financial constraints.

Downloads

References

Araújo, B. C (2011). Indústria de bens de capital. In: DE NEGRI, J. A.; LEMOS, M. B. O núcleo tecnológico da indústria brasileira. Brasília: Ipea/Finep/ABDI, v.1, p. 409-514.

Audretsch, D. B., & Belitski, M. (2020). The role of R&D and knowledge spillovers in innovation and productivity. European Economic Review, 123: 103391. https://doi.org/10.1016/j.euroecorev.2020.103391

Audretsch, D. B., Kritikos, A. S., & Schiersch, A. (2020). Microfirms and innovation in the service sector. Small Business Economics, 55: 997–1018. https://doi.org/10.1007/s11187-020-00366-4

Baumann, J., & Kritikos, A. S. (2016). The link between R&D, innovation and productivity: Are micro firms different? Research Policy, 45: 1263–1274. https://doi.org/10.1016/j.respol.2016.03.008

Bloom, Nicholas. (2014). Fluctuations in uncertainty. Jornal of Economic Perspectives, 28: 30–55. https://doi.org/10.32609/0042-8736-2016-4-30-55

Bloom, Nick, Bond, S., & Van Reenen, J. (2007). Uncertainty and investment dynamics. Review of Economic Studies, 74: 391–415. https://doi.org/10.1111/j.1467-937X.2007.00426.x

Carboni, O. A., & Medda, G. (2021). External R&D and product innovation: Is over-outsourcing an issue? Economic Modelling, 103: 105601. https://doi.org/10.1016/j.econmod.2021.105601

Coad, A. (2011). Appropriate business strategy for leaders and laggards. Industrial and Corporate Change, 20: 1049–1079. https://doi.org/10.1093/icc/dtr012

Cook, K. A., Romi, A. M., Sánchez, D., & Sánchez, J. M. (2019). The influence of corporate social responsibility on investment efficiency and innovation. Journal of Business Finance and Accounting, 46: 494–537. https://doi.org/10.1111/jbfa.12360

Czarnitzki, D., & Toole, A. A. (2013). The R and D investment-uncertainty relationship: Do strategic rivalry and firm size matter? Managerial and Decision Economics, 34: 15–28. https://doi.org/10.1002/mde.2570

de Campos, Marcel Groppo, David Ferreira Lopes Santos, & Frederico Andreis Beneli Donadon (2018). Impacto dos investimentos em inovação na indústria brasileira. Revista Gestão Industrial 13.3.

Desveaux, L., Soobiah, C., Bhatia, R. S., & Shaw, J. (2019). Identifying and overcoming policy-level barriers to the implementation of digital health innovation: Qualitative study. Journal of Medical Internet Research, 21: 1–10. https://doi.org/10.2196/14994

FAPESP. Relatório de Atividades de 2011. 2011. In: http://www.fapesp.br/publicacoes/relat2011_completo.pdf. Access at: 2016, aug, 20.

García-Quevedo, J., Segarra-Blasco, A., & Teruel, M. (2018). Financial constraints and the failure of innovation projects. Technological Forecasting and Social Change, 127: 127–140. https://doi.org/10.1016/j.techfore.2017.05.029

Greene, H. (2012). Econometric analysis, 7ª. ed. Boston: Prentice-Hall.

Hall, B. H., Moncada-Paternò-Castello, P., Montresor, S., & Vezzani, A. (2016). Financing constraints, R&D investments and innovative performances: New empirical evidence at the firm level for Europe. Economics of Innovation and New Technology, 25: 183–196. https://doi.org/10.1080/10438599.2015.1076194

Hall, B. H. (2002). The financing of research and development. Oxford Review of Economic Policy, 18: 35–51. https://doi.org/10.1093/oxrep/18.1.35

Hall, B. H., Lotti, F., & Mairesse, J. (2013). Evidence on the impact of R&D and ICT investments on innovation and productivity in Italian firms. Economics of Innovation and New Technology, 22: 300–328. https://doi.org/10.1080/10438599.2012.708134

Hervas-Oliver, J. L., Sempere-Ripoll, F., & Boronat-Moll, C. (2021). Technological innovation typologies and open innovation in SMEs: Beyond internal and external sources of knowledge. Technological Forecasting and Social Change, 162: 120338. https://doi.org/10.1016/j.techfore.2020.120338

Hottenrott, H., & Richstein, R. (2020). Start-up subsidies: Does the policy instrument matter? Research Policy, 49: 103888. https://doi.org/10.1016/j.respol.2019.103888

IBGE. (2022). PINTEC - Pesquisa de Inovação. https://www.ibge.gov.br/estatisticas/multidominio/ciencia-tecnologia-e-inovacao/9141-pesquisa-de-inovacao.html?=&t=sobre

Janger, J., Schubert, T., Andries, P., Rammer, C., & Hoskens, M. (2017). The EU 2020 innovation indicator: A step forward in measuring innovation outputs and outcomes? Research Policy, 46: 30–42. https://doi.org/10.1016/j.respol.2016.10.001

Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Accounting Review, 91: 1697–1724. https://doi.org/10.2308/accr-51383

Knack, S., & Keefer, P. (1997). Does social capital have an economic payoff? A cross-country investigation. Quarterly Journal of Economics, 112: 1251–1288. https://doi.org/10.1162/003355300555475

Lahr, H., & Mina, A. (2020). Endogenous financial constraints and innovation. Industrial and Corporate Change, 1-35. https://doi:10.1093/icc/dtaa035

Lanz, L. Q., & Tomei, P. A. (2016). Managing risks and stakeholders in the design of a new financial product. International Journal of Innovation, 4: 59–70.

Michaelis, T. L., & Markham, S. K. (2017). Innovation training: Making innovation a core competency. Research Technology Management, 60: 36–42. https://doi.org/10.1080/08956308.2017.1276387

OECD. (2005). Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data.

OECD. (2018). Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation. In Handbook of Innovation Indicators and Measurement (4a.). Paris/Eurostat. https://doi.org/10.1787/9789264304604-en

Oliver-Espinoza, R., & Stezano, F. (2021). Effect of private and public investment in R&D on innovation in Mexico’s biotechnology firms. Journal of Science and Technology Policy Management, 257242. https://doi.org/10.1108/JSTPM-10-2020-0156

Pellegrino, G., & Savona, M. (2017). No money, no honey? Financial versus knowledge and demand constraints on innovation. Research Policy, 46: 510–521. https://doi.org/10.1016/j.respol.2017.01.001

Pivoto, D., Waquil, P. D., Talamini, E., Finocchio, C. P. S., Dalla Corte, V. F., & de Vargas Mores, G. (2018). Scientific development of smart farming technologies and their application in Brazil. Information Processing in Agriculture, 5: 21–32. https://doi.org/10.1016/j.inpa.2017.12.002

Poyago-Theotoky, J. (1998). R&D competition in a mixed duopoly under uncertainty and easy imitation. Journal of Comparative Economics, 26: 415–428. https://doi.org/10.1006/jcec.1998.1541

Rammer, C., Czarnitzki, D., & Spielkamp, A. (2009). Innovation success of non-R&D-per-formers: substituting technology by management in SMEs. Small Business Economics, 33. https://doi.org/10.1007/s11187-009-9185-7

Rammer, C., & Schubert, T. (2018). Concentration on the few: mechanisms behind a falling share of innovative firms in Germany. Research Policy, 47: 379–389. https://doi.org/10.1016/j.respol.2017.12.002

Robertson, P. L.; & Patel, P. R (2007). New wine in old bottles technological diffusion in developed economies. Research Policy, 36: 708–721

Rocha, L. A., Dal Poz, M. E., Almeida, C. A. S. de, & Oliveira, D. M. de. (2015). O Impacto Dos Esforços Inovativos No Desempenho Econômico-Financeiro Das Empresas. Review of Administration and Innovation - RAI, 12(3), 82. https://doi.org/10.11606/rai.v12i3.101240

Rogers, E. M. (2003). Diffusion of Innovations (5th Edition). Free Press: New York, NY, USA.

Santos, D. F. L. Basso, L. F. C.; & Kimura, H (2012). A Estrutura da Capacidade de Inovar das Empresas Brasileiras: Uma Proposta de Construto. Revista de Administração e Inovação, São Paulo, v. 9, n.3, p. 103-128.

Saunders, M., Lewis, P., & Thornhill, A. (2007). Research methods for business students (4a). Pearson Education.

Schumpeter, J. A. (1939). Business cycles. McGraw-Hill Book Company. https://doi.org/10.4324/9780203075616-20

Stein, L. C. D., & Stone, E. (2012). The effect of uncertainty on investment: Evidence from options. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1649108

Strachman, E.; Avellar, A. P. M. (2008). Estratégias, desenvolvimento tecnológico e inovação no setor de bens de capital, no Brasil. Ensaios FEE, Porto Alegre, v.29, n.1, p. 237¬ 266

Tajaddini, R., & Gholipour, H. F. (2021). Economic policy uncertainty, R&D expenditures and innovation outputs. Journal of Economic Studies, 48: 413–427. https://doi.org/10.1108/JES-12-2019-0573

Taveira, J. G., Gonçalves, E., & Freguglia, R. D. S. (2019). The missing link between innovation and performance in Brazilian firms: a panel data approach. Applied Economics, 51: 3632–3649. https://doi.org/10.1080/00036846.2019.1584374

Vrchota, J., & Řehoř, P. (2019). Project management and innovation in the manufacturing industry in Czech Republic. Procedia Computer Science, 164: 457–462. https://doi.org/10.1016/j.procs.2019.12.206

Wen, H., Lee, C. C., & Zhou, F. (2022). How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China's new energy industry. Energy Economics, 105: 105767.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Túlio Silva Oliveira, Cândido Vieira Borges Júnior, Mauro Caetano

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

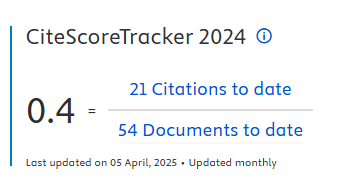

- Abstract 700

- PDF 338

- PDF (Português (Brasil)) 415